Today’s Valuation Of Darden Restaurants Stock Update

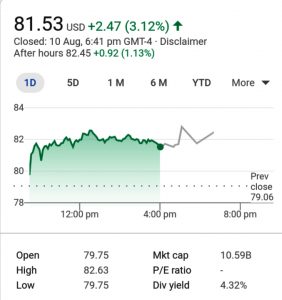

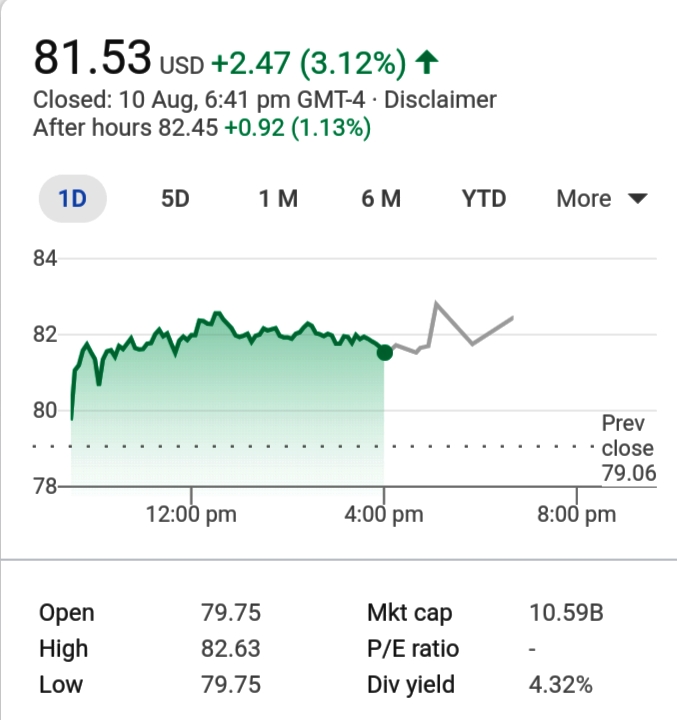

On Friday, August 07, 2020, the Company, Darden Restaurants, Inc., DRI stock build a difference of 3.36 percent (↑/Gain) in a sum of its offer cost and having its exchanging esteem of $79.06, which has a place with Consumer Cyclical segment and Restaurants industry. The organization’s Market capitalization was $9.94B with all-out Outstanding Shares of 129.82M.

Darden Restaurants, Inc.’s institutional possession is remaining at 92.9 percent, while insider proprietorship is 0.4 percent. Starting at now, DRI has P/S, P/E, and, P/B estimations of 1.27, 0, and 4.22 individually. Its P/Cash is esteemed at 13.02.

The stock SMA50 is currently at 3.58 percent. In looking, at the SMA 200, we see that the stock has seen a – 12.34 percent. The Company’s net revenue for a year is at – 0.7 percent. Relatively, the looks have a Gross edge of 18 percent.

Gainfulness proportions:

Investigating the gainfulness proportions of DRI stock, a financial specialist will discover its ROE, ROA, ROI remaining at – 2.2 percent, – 0.5 percent and, 0.4 percent, separately.

Beta Factor:

A beta factor is utilized to quantify the unpredictability of the stock. The stock stays at 3.74 percent unpredictable for the week and 3.93 percent for the month.

Net/Operating Margins of Darden Restaurants:

It ascertains what amount out of each dollar of deals an organization keeps in profit. Net Margin is seen at 18 percent and Operating Margin is seen at – 1.3 percent.

Target Price:

Target Price educates financial specialists, a stock study at which a broker is eager to purchase or sell a stock. At which a merchant extends that a purchaser will purchase an item. The organization Darden Restaurants, Inc. recorded it at $85.97.

Investigating the exhibition of Darden Restaurants, Inc. stock, a financial specialist will come to realize that the week-by-week execution for this stock is esteeming at 4.16 percent, bringing about a presentation for the month at 10.82 percent.

Hence, the expressed figure shows a quarterly presentation of 5.81 percent, carrying half-year execution to – 34.5 percent and year-to-date execution of – 27.47 percent. Starting at now, Darden Restaurants, Inc. has P/S, P/E, and, P/B estimations of 1.27, 0, and 4.22 separately. Its P/Cash is esteemed at 13.02.

Recent Posts

Darden Restaurants Financial Updates 2020

PNC Pathfinder Employee Login Portal

Myvikingjourney Sign-In Easy Guide

Darden Restaurants, Inc. Income per Share Details

The EPS of Darden Restaurants, Inc. is walking around – 0.37, estimating its EPS development this year at – 107 percent. Subsequently, the organization has an EPS development of 84.56 percent for the moving toward year.

EPS development is a significant number as it gives a proposal of things to come possibilities of an organization. It is normally communicated as a rate and is then alluded to as the EPS development rate.

Development in EPS is a significant proportion of organization execution since it shows how much cash the organization is making for its speculators or investors, as a result of changes in benefit as well as after all the impacts of issuance of new offers (this is particularly significant when the development comes because of obtaining).

Given the significance of recognizing organizations that will guarantee income per share at a tall rate, we later fixation to umpire how to distinguish which organizations will accomplish high accumulating rates. One clear flaunting to recognize high income per partition tally together organizations is to find organizations that have exhibited such development over the p.s. 5 to 10 years.

We can’t have enough upkeep the once will consistently mirror the troublesome, yet sensibly stocks that have developed income per stipend unequivocally in the ensuing to are a fine wagered to keep on producing results thus.

If you are an employee of Krowd Darden and have the following questions.

How do I log in to Krowd Darden?

How to activate the Krowd account?

How do I get my W2 from Krowd?

Then visit our Krowd Darden Login Step-by-step Guide.

1 thought on “Valuation Of Darden Restaurants Stock Today”