New Olive Garden Pickup Offers

During the Coronavirus Olive Garden makes shopping easier for customers. Olive Garden Pickup offer, offering a buy one, take one to go car side pickup. Olive Garden buy one, take one offer starting from $12.99.

Olive Garden Said “We are committed to serving your family their favorites ToGo now with contactless Carside Pickups.

Customers of Olive Garden can choose one hot and ready-to-eat entrée and they choose one free entrée, which will be freshly prepared for the next day.

Olive Garden Pickup Offers

During Coronavirus Pandemic

- Take one Spaghetti with Meat Sauce, Five Cheese Ziti al Forno, Fettuccine Alfredo, Cheese Ravioli.

- Buy One Spaghetti with Meat Sauce, Fettuccine Alfredo, Cheese Ravioli, Chicken Parmigiana, Five Cheese Ziti Al Forno, Lasangna.

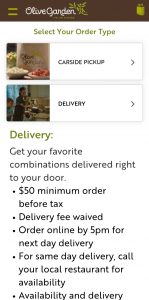

You can Order at Olive Garden after paying online, you can pick it up from the Olive Garden Restaurant without leaving your car.

Due to Coronavirus Pandemic COVID-19. Also, you can get your order delivered with free Olive Garden no-contact delivery if qualifying for an order.

Olive Garden Volume in Coronavirus Pandemic Lockdown

Takeout and Olive Garden delivery sales have continued to climb at Darden Restaurants’ Olive Garden and LongHorn Steakhouse chains, with weekly sales rising to nearly $53,000 and $29,000, respectively, for the seven days that ended April 19.

Krowd Darden also revealed Monday afternoon that it has slowed its cash burn rate to $20 million per week and that it has filed for a public offering of about $458 million in common stock–7.8 million shares at $58.50 each– with the proceeds to be used for general corporate purposes. Underwriters can purchase an additional 1.2 million shares at the offering price.

In roughly a month, weekly off-premise sales for Olive Garden have nearly tripled, from an annual run rate of $1.1 million to $2.8 million. The increase has tempered the decline in same-store sales for the Italian full-service chain to 44.8% for the week ended April 19.

Comparable weekly sales for LongHorn were down 59.2%, compared with a 66.3% decline for the prior week.

The two brands are Darden’s biggest by far, accounting for about 1,400 of the company’s 1,812 casual-dining restaurants. The dining rooms of virtually all the outlets have been closed, though they continue to offer takeout and delivery.

Olive Garden in particular had a strong off-premise business before the COVID-19 pandemic, but exclusively because of takeout and big-order delivery.

The chain had refused to follow most of the casual dining into the delivery of single-entree meals, setting a minimum order of $75, and only if the order was placed by 5 p.m. the preceding day. It has since dropped that policy and developed its ability to deliver smaller orders.

Darden’s fine-dining group, which includes The Capital Grille and Eddie V’s chains, did not fare as well as its lower-priced sister operations. Same-store sales for the high-end group were down 86.3%, or 10 percentage points worse than the decline for the prior week.

The company said it intends to sell $400 million in stock to help raise cash to make it through the shutdown.

Olive Garden Losing Job Openings

Social Engagement in the Coronavirus Pandemic

Darden Restaurants ($NYSE: DRI), the company that owns several chains including Olive Garden, might have something to worry about, and it’s not just what’s been in the news lately.

Olive Garden Photoshopping High School Proms.

The past few weeks have seen a blistering number of stories pop up about the Orlando-based business, including Olive Garden photoshopping high school proms, Darden raising half a billion by offering common stocks, and the stock price jumping as executives cut their pay.

Originally, we looked into Darden’s data because it had lost 44.7% of its sales during the fourth quarter. But miraculously, takeout and to-go orders have tripled over the past month, causing a bounceback in the stock price.

When we visualize every data point we have on Darden and its biggest brand, Olive Garden, we can see just how devastating the global pandemic and self-quarantine have been on business.

Olive Garden was as steady as a rock over the past year in terms of job listings, but that finally gave way in early April, as the job openings dropped 15% over the last three weeks. Still, leadership is boasting about its takeout business.

“Our brand teams continue to work extremely hard to deliver exceptional To Go experiences to our guests,” said Gene Lee, CEO of Darden. “We are proud of our team’s ability to adapt and their dedication to producing results that consistently outperform our expectations and are building momentum.”

The same thing happened to Darden’s corporate job postings over the past six weeks, falling 74% as the executive salary cuts were being implemented.

Over the past two years, the number of Facebook likes and people talking about Olive Garden has been going down, a rarity for social media followings we track and cover.

This isn’t an indictment of the restaurant, but simply a sign that online chatter and buzz aren’t what they used to be. As a growing number of US states contemplate partial reopening, it remains to be seen whether even a half-full dining area can translate into a rebound for Darden.

Thinknum tracks companies using the information they post online – jobs, social and web traffic, product sales, and app ratings – and creates data sets that measure factors like hiring, revenue, and foot traffic.

Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.

1 thought on “Olive Garden New Pickup Offers”